Matthew J. Previte Cpa Pc for Beginners

Wiki Article

6 Simple Techniques For Matthew J. Previte Cpa Pc

Table of ContentsThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is DiscussingSome Ideas on Matthew J. Previte Cpa Pc You Need To KnowMatthew J. Previte Cpa Pc - QuestionsThe 7-Second Trick For Matthew J. Previte Cpa PcThe 7-Second Trick For Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc - Truths

Tax obligation regulations and codes, whether at the state or federal level, are too complicated for the majority of laypeople and they alter as well frequently for lots of tax experts to stay up to date with. Whether you simply require someone to help you with your service earnings tax obligations or you have actually been billed with tax scams, work with a tax obligation attorney to assist you out.

How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

Every person else not just disapproval taking care of taxes, however they can be outright afraid of the tax companies, not without reason. There are a couple of concerns that are always on the minds of those who are dealing with tax problems, consisting of whether to employ a tax lawyer or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax obligation attorney, and We want to assist answer those inquiries here, so you understand what to do if you find on your own in a "taxing" scenario.

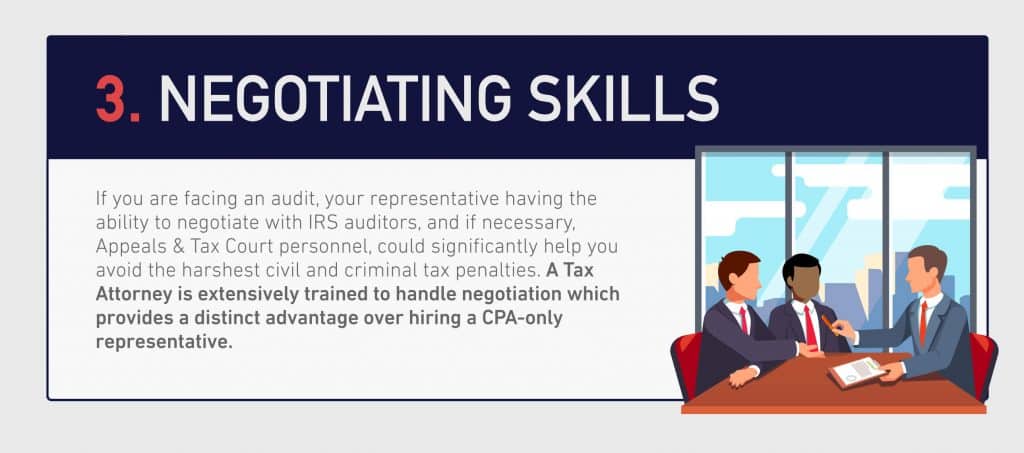

An attorney can stand for clients before the IRS for audits, collections and charms yet so can a CPA. The huge distinction here and one you need to bear in mind is that a tax obligation lawyer can offer attorney-client advantage, indicating your tax obligation lawyer is exempt from being obliged to indicate versus you in a law court.

The Main Principles Of Matthew J. Previte Cpa Pc

Otherwise, a certified public accountant can indicate versus you also while helping you. Tax lawyers are a lot more aware of the various tax negotiation programs than many Certified public accountants and know how to pick the ideal program for your instance and how to obtain you gotten approved for that program. If you are having an issue with the IRS or just questions and concerns, you require to work with a tax lawyer.

Tax obligation Court Are under investigation for tax scams or tax evasion Are under criminal examination by the internal revenue service Another vital time to employ a tax lawyer is when you receive an audit notification from the IRS - IRS Levies in Framingham, visit this site right here Massachusetts. https://www.bitchute.com/channel/tOLy7GNhu4qP/. A lawyer can interact with the internal revenue service in your place, exist during audits, assistance discuss negotiations, and keep you from overpaying as an outcome of the audit

Part of a tax attorney's responsibility is to stay on par with it, so you are protected. Your best resource is word of mouth. Ask about for a skilled tax obligation attorney and inspect the web for client/customer evaluations. When you interview your choice, request for added references, specifically from clients that had the same problem as yours.

All About Matthew J. Previte Cpa Pc

The tax obligation legal representative you have in mind has every one of the best qualifications and reviews. Every one of your concerns have actually been answered. tax lawyer in Framingham, Massachusetts. Should you employ this tax obligation lawyer? If you can afford the charges, can accept the sort of prospective remedy supplied, and believe in the tax lawyer's ability to assist you, after that of course.The choice to work with an internal revenue service attorney is one that should not be taken lightly. Attorneys can be extremely cost-prohibitive and complicate matters needlessly when they can be fixed reasonably conveniently. As a whole, I am a large advocate of self-help legal remedies, especially provided the range of informational product that can be located online (including much of what I have actually published on tax).

Examine This Report about Matthew J. Previte Cpa Pc

Here is a quick list of the issues that I think that an Internal revenue service attorney should be hired for. Wrongdoer charges and criminal examinations can damage lives and lug extremely significant repercussions.

Lawbreaker charges can likewise carry extra civil fines (well past what is regular for civil tax issues). These are just some examples of the damage that also just a criminal charge can bring (whether a successful conviction is inevitably acquired). My factor is that when anything potentially criminal arises, also if you are just a possible witness to the issue, you require an experienced IRS attorney to represent your rate of interests versus the prosecuting firm.

This is one instance where you always need an IRS lawyer viewing your back. There are several components of an Internal revenue service attorney's job that are relatively routine.

Fascination About Matthew J. Previte Cpa Pc

Where we earn our stripes though gets on technical tax issues, which placed our complete skill established to the examination. What is a technical tax issue? That is a hard question to answer, however the most effective means I would certainly describe it are issues that require the expert judgment of an internal revenue service lawyer to resolve appropriately.Anything that possesses this "truth dependence" as I would call it, you are going to desire to bring in a lawyer to speak with - IRS Levies in Framingham, Massachusetts. Also if you do not maintain the services of that lawyer, an expert viewpoint when dealing with technological tax obligation matters can go a long means towards understanding issues and settling them in an ideal fashion

Report this wiki page